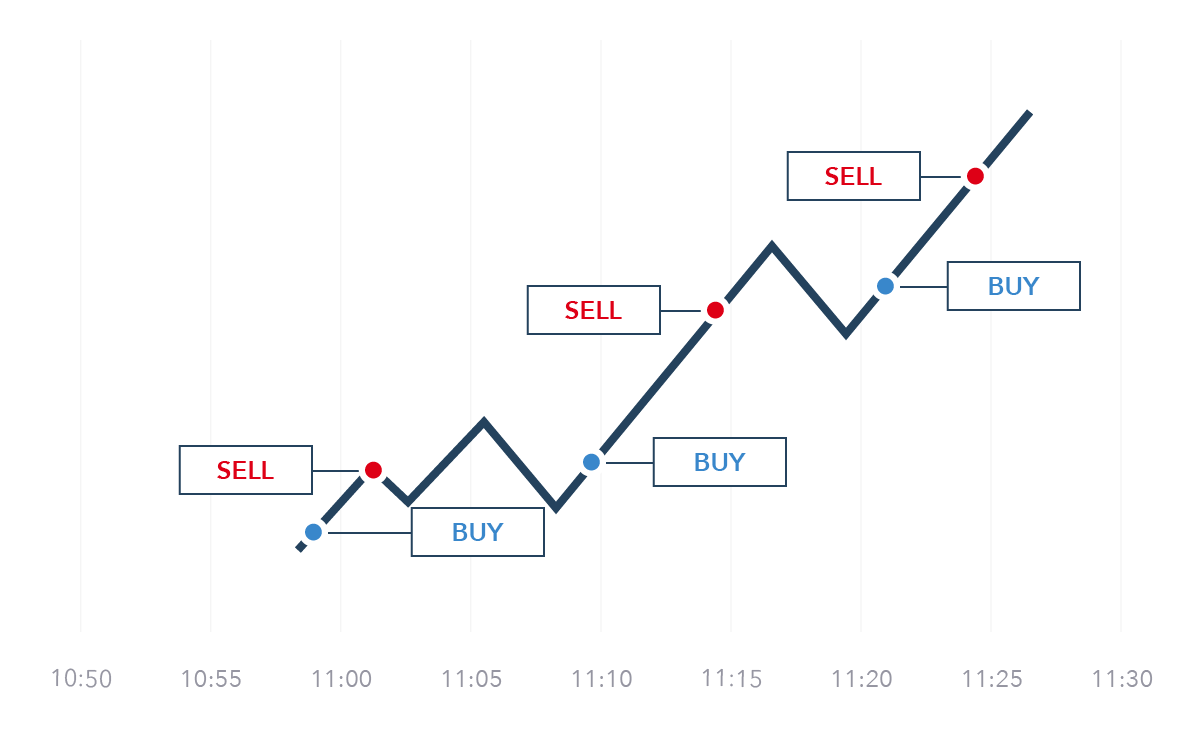

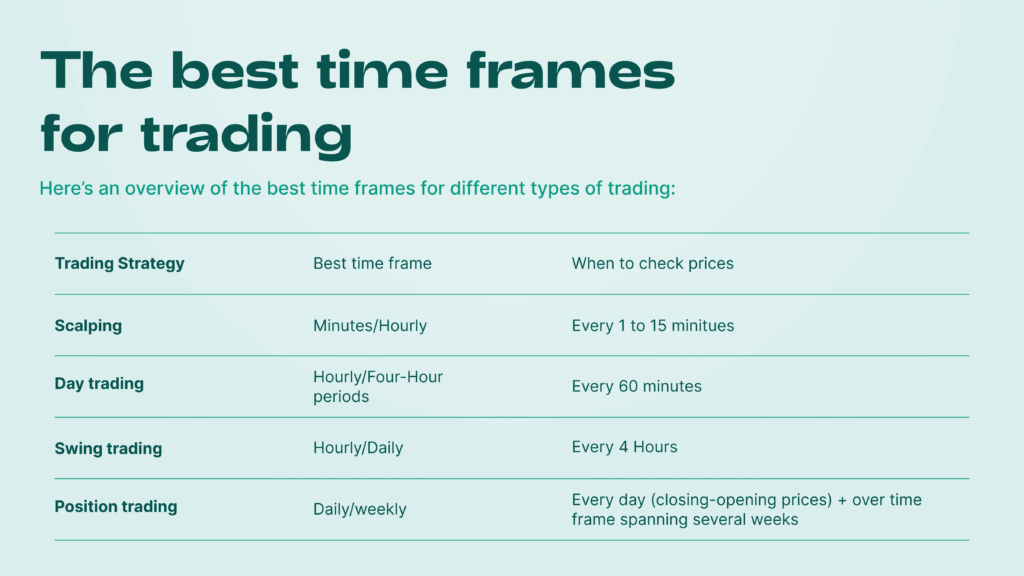

Short-term time frames in forex trading typically range from one minute to one hour. These time frames are ideal for day traders who make quick decisions based on short-term price movements. Analyzing charts on short-term time frames can help traders identify short-term trends and potential entry and exit points for their trades. However, it’s important to note that short-term time frames can be more volatile and subject to noise, so it’s essential to use other technical indicators to confirm signals.

Medium-term time frames in forex trading usually range from four hours to one day. These time frames are popular among swing traders who hold positions for a few days to a few weeks. Analyzing charts on medium-term time frames can help traders identify medium-term trends and potential support and resistance levels. Traders can also use a combination of technical indicators and chart patterns to make more informed trading decisions on medium-term time frames.

Long-Term Time Frames

Long-term time frames in forex trading typically range from one week to one month or even longer. These time frames are suitable for long-term investors who hold positions for months to years. Analyzing charts on long-term time frames can help investors identify major trends and significant price levels. Long-term traders often use fundamental analysis in conjunction with technical analysis to make informed decisions based on economic indicators and geopolitical events.