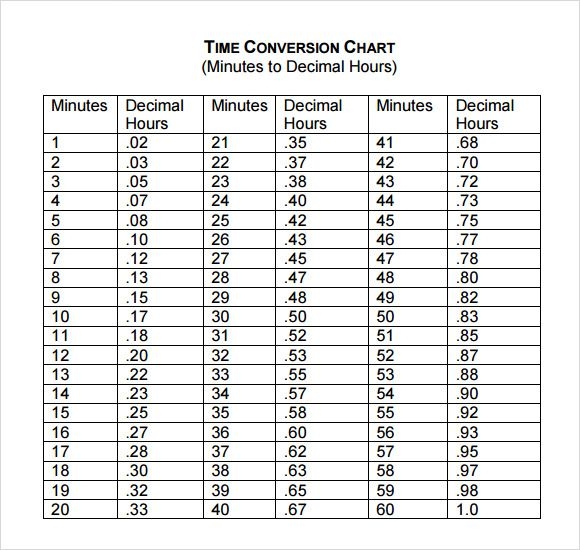

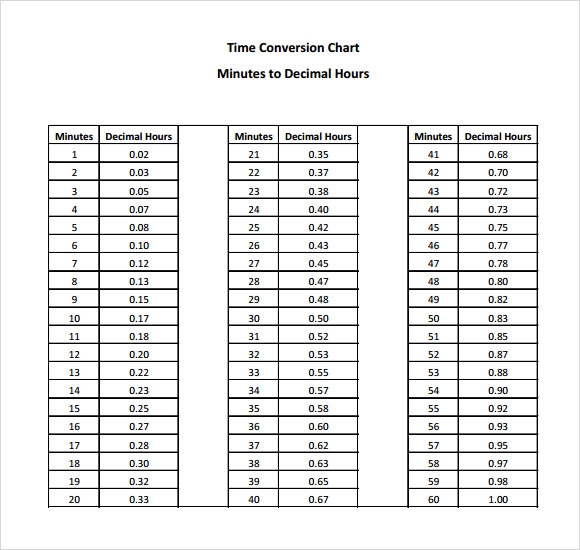

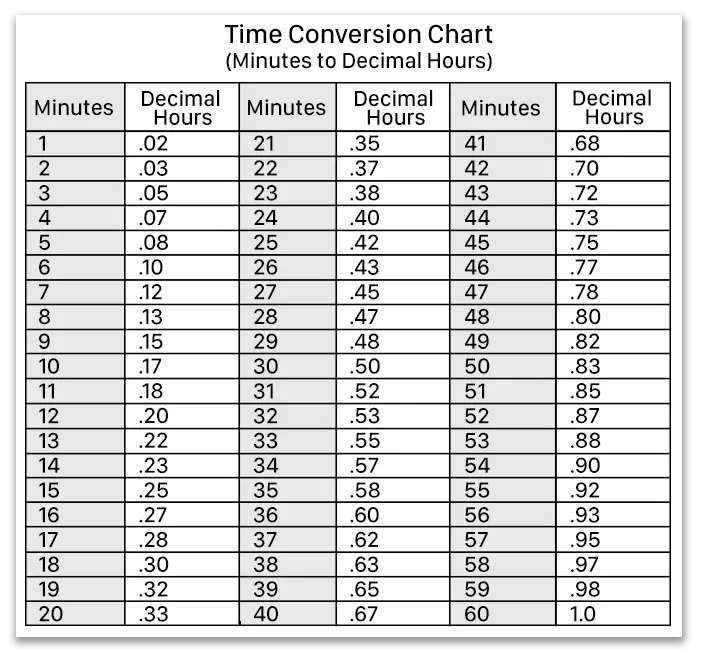

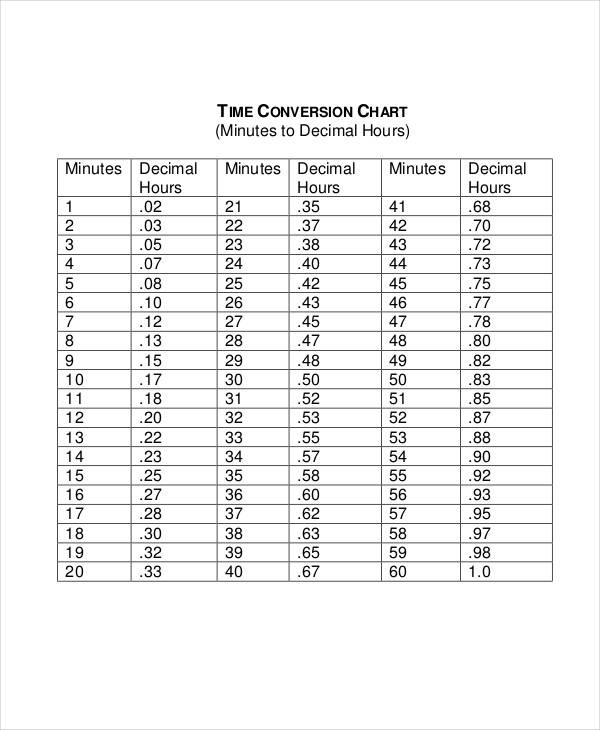

A time sheet conversion chart is a tool used to convert hours and minutes into decimal form for easier calculation of work hours. This chart helps in simplifying the process of calculating employee hours, especially for payroll purposes. By using a time sheet conversion chart, employers can accurately track and calculate the total number of hours worked by their employees.

For example, if an employee works 8 hours and 30 minutes in a day, the time sheet conversion chart can help in converting this time into decimal form, such as 8.5 hours. This makes it easier to calculate wages and overtime pay based on the total hours worked.

How to Use a Time Sheet Conversion Chart?

Using a time sheet conversion chart is simple and straightforward. To convert hours and minutes into decimal form, follow these steps:

1. Identify the total number of hours worked by the employee.

2. Determine the number of minutes worked, if any.

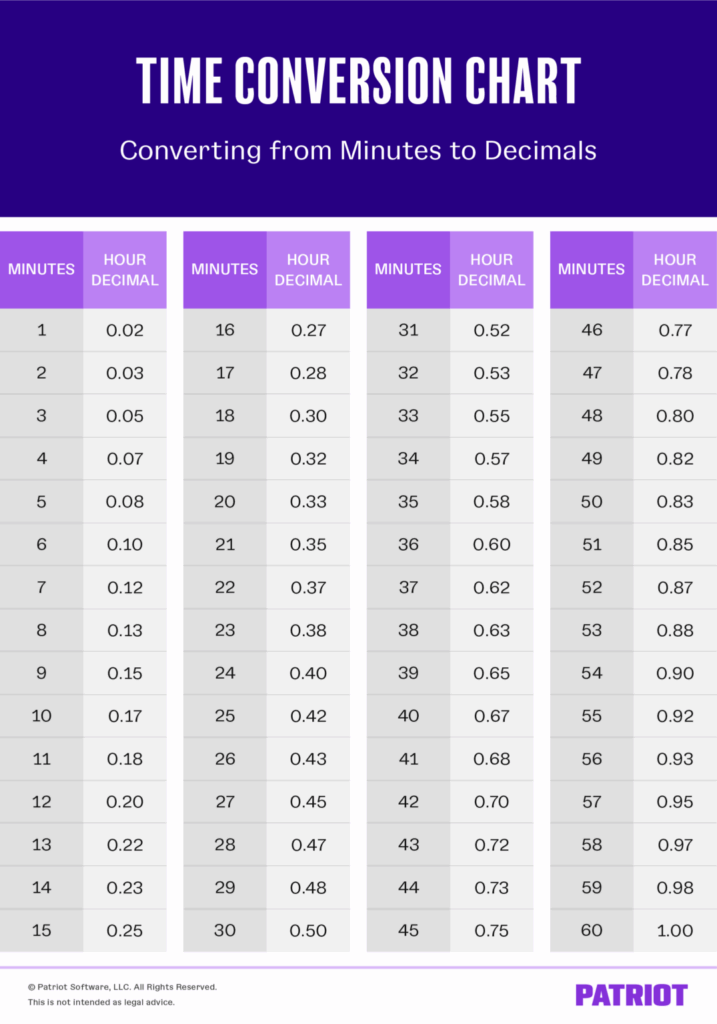

3. Refer to the time sheet conversion chart to convert the hours and minutes into decimal form.

4. Add the converted hours to calculate the total work hours for the day or week.

By following these steps and using a time sheet conversion chart, employers can accurately track and calculate employee work hours, making the payroll process more efficient and error-free.

Benefits of Using a Time Sheet Conversion Chart

There are several benefits to using a time sheet conversion chart, including:

1. Accuracy: By converting hours and minutes into decimal form, employers can ensure accurate calculations of work hours for payroll purposes.

2. Efficiency: Using a time sheet conversion chart simplifies the process of calculating employee hours, saving time and reducing errors.

3. Compliance: Accurately tracking and calculating work hours ensures compliance with labor laws and regulations regarding wages and overtime pay.

In conclusion, a time sheet conversion chart is a valuable tool for employers to accurately track and calculate employee work hours. By using this chart, employers can improve the efficiency and accuracy of their payroll process, ensuring compliance with labor laws and regulations.