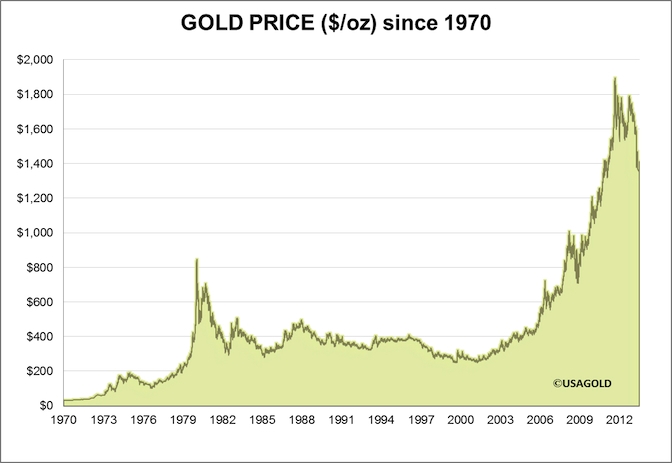

Gold has been a valuable commodity for centuries, and its price has fluctuated over time in response to various economic and geopolitical factors. A gold prices over time chart can provide valuable insights into the historical trends of this precious metal.

Historically, gold has been used as a store of value and a safe-haven asset during times of economic uncertainty. As a result, its price tends to rise during periods of inflation or market volatility. By examining a gold prices over time chart, investors can track these trends and make informed decisions about when to buy or sell gold.

Factors Influencing Gold Prices

Several factors can influence the price of gold, including supply and demand dynamics, interest rates, currency fluctuations, and geopolitical events. These factors can cause gold prices to fluctuate on a daily basis, making it essential for investors to stay informed about the latest market trends.

By studying a gold prices over time chart, investors can gain a better understanding of how these factors have historically impacted the price of gold. This knowledge can help investors identify patterns and trends that may inform their investment decisions in the future.

Using Gold Prices Over Time Chart for Investment

Investors can use a gold prices over time chart as a tool to analyze historical trends and make informed decisions about buying or selling gold. By examining how gold prices have performed in the past, investors can identify potential opportunities for profit and mitigate risks associated with market volatility.

Additionally, a gold prices over time chart can help investors track the performance of their gold investments over time and assess their overall portfolio strategy. By staying informed about the latest market trends and using historical data as a guide, investors can maximize their returns and achieve their investment goals.